Floyd Norris reports:

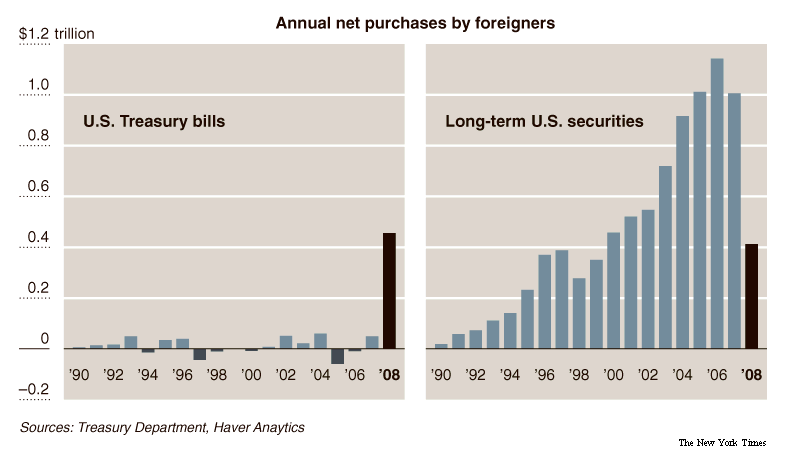

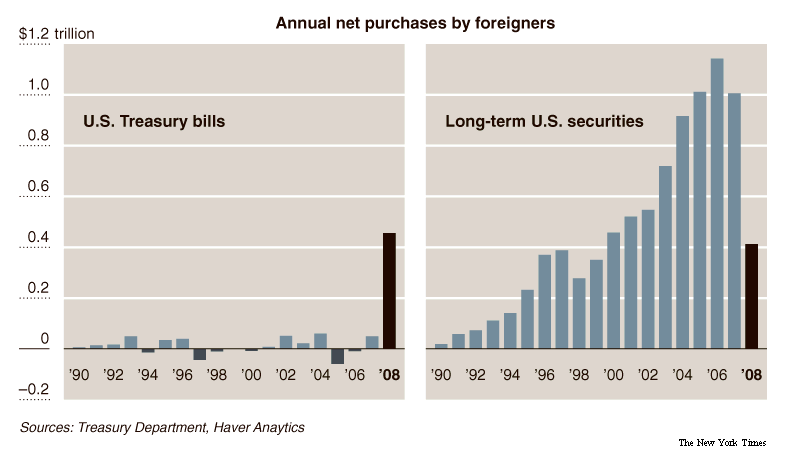

The government said this week that net purchases of [long term] securities fell to $412.5 billion in 2008, less than half the 2007 level and the lowest annual total since 1999, when the federal government was running a budget surplus.

Money did come in, but it was diverted into the safest investment around, albeit one with almost no expectation of profit, Treasury bills. Overseas investors increased their holdings of those securities by $456 billion, an unprecedented flow.

Relying on foreign investors to fund our deficit is not unlike running a Ponzi scheme. It’s fine as long as new money comes in, but when the money flow stops, we’re effed. As the chart below shows, we’re now addicted to foreigners’ short term financing.

Permalink | Comments

A friend in San Francisco, a graduate of Harvard Business School and former Jack Welch protege, writes: “Dude, you would be proud of me — I even got on facebook last week….twitter next?” I respond:

Dear Arpad,

Speaking of technological advances, you might also want to have one of your cleverer butlers investigate these new portable telephonic devices. I’m unsure about the advisability of walking and talking at the same time, but potentially an uncorded telephone could be useful when one needs to

visit the toilet.

Or perhaps one could just purchase a longer telephone cord? (Note to personal secretary: Monday cable Bear Stearns, instructing them to buy on our behalf 1000 shares in our nation’s biggest wire manufacturer, Consolidated Brass Tacks and Tarpaper, at a price limit of 11 & 3/8ths. That was the price last April and I assume it has not moved since.)

Now, Aprad, I hope you are sitting down because I have to share something else shocking. I don’t know what the newspapers in The West are writing about, but here in North Carolina, some crazed journalists predict that one might, some day in the distant future, convey short textual information

through these mobile telephonic devices (“teles?”).

I think THAT is clearly absurd. Man will sooner walk on the moon than type correspondences into a telephone. For one thing, how could this typing be achieved with a rotary enumerator? And what would decipher the text and translate it back into speech so it can be comprehended? The mind boggles. Finally, and most importantly, even if all this flapadoodle were possible from the standpoint of the engineering gents, it seems clear to me that such information as shopping lists, theatrical scripts, marriage proposals and business propositions should ONLY be composed at leisure using pen and ink. Why would one rush to create or convey such information? Clearly great harm could come from ill-considered missives composed when one is in one’s cups and reposed on the toilet.

Yes, the mind boggles.

I hope you and your family remain in good health, and I remain, as ever, your friend in anachronism…

Mr. Copeland

Permalink | Comments

Two other blog advertising competitors bow out without so much as a whimper:

Back when the election season first started I joined MSNBC Politics advertising network. They promised fifty five cents per one thousand impressions and they delivered. As soon as the election was over they quit advertising on my site without explanation. I finally contacted them and they gave a poor explanation that their company was going in a different direction now that the political season was over. I also joined the Buzzlogic advertising network in their beta period. They promised two dollars per one thousand impressions and they delivered as well, until this month. I basically got the same explanation as I got from MSNBC’s network. They won’t be advertising with us in the near future.

Permalink | Comments

Worth writing about only because it will be headlines of tomorrow’s NYTimes biz section.

This will be below the headline about Citibank being put out of its misery by the government, of course.

Permalink | Comments

The world’s biggest mutual fund, PIMCO’s Total Return fund, has $132 billion in assets. The fund has been gaining new fans based on its conservative management and steady returns as other mutual funds tanked.

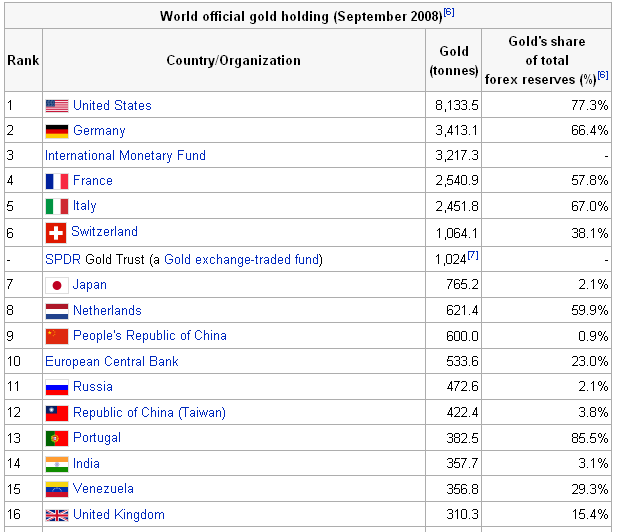

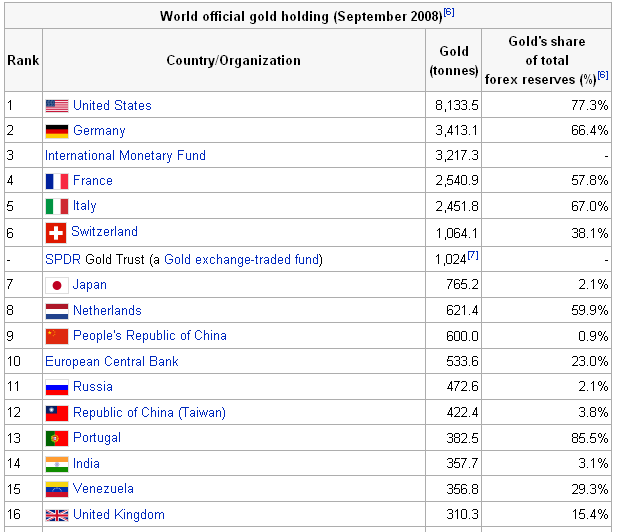

PIMCO is a great reference point for understanding just how scarce gold is, relative to the pool of money that might be scrambling for some ballast amid today’s financial hurricanes.

The ~1000 tons of gold held in the SPDR GLD fund, a gold-backed security that currently constitutes the world’s seventh largest stockpile of gold, are worth only $23 billion.

From Wikipedia.

From Wikipedia.

Permalink | Comments

You know “social media marketing” (so-me-marcom?) is totally mainstream when a fortune teller, being interviewed by NPR about how the recession is helping her business, mentions that she uses her twitter account for “customer retention” and the journalist doesn’t make that the point of the story.

At 8:09 Eastern, said seer, Alexandra Chauran aka /earthshod, has 276 followers.

Next to last tweet: “My fortune cookie: “A blonde from afar has something interesting for you.” WTF to DEATH with that cookie?”

OK, I’m following her.

It’ll be an interesting test of the twitter/NPR/so-me-marcom nexus to check, at the end of the day, how many radio listeners have followed her.

Playing so-me-marcom-seer myself, I’ll predict >500, with a good chance Alexandra meets an enriching new life-partner if she’s remains vigilant to the day’s wonderful potential. (And she’ll rival Scoble a few months out if the twitteroi adopt her as The Official Twitter Sage.)

Permalink | Comments

The board members of the Federal Reserve are becoming more pessimistic about the economy. Bloomberg reports:

Fed officials, at their policy meeting in late January, said the economy would contract between 0.5% and 1.3% this year, far worse than their October projections spanning between a 0.2% decline and 1.1% expansion. The figures exclude the three highest and lowest forecasts of the Fed’s 16 sitting policy makers at the time. If all projections are included, the output forecast ranges from a decline of 2.5% to a gain of 0.2%.

The odd thing about these projections, or those of most private economists, is that they are an order of magnitude less severe than any numbers that real businesses are experiencing at present. (For that matter, last year’s numbers are suspciously mild, with GDP contracting 4.3% in the second half of ’08.)

Car sales are down 30-40% year over year. Housing construction is off 17% versus a year ago. Layoffs each week have doubled versus a year ago. Many retailers are seeing 10-20% contraction in sales. Industrial production dropped 1.7% last month alone. (Off nearly 12% in the last year.)

Virtually the only big name companies that are reporting ANY significant growth are Walmart (+2.8% year over year), McDonalds (+5.4% year over year) and Google (growing 3% a quarter?) The only segments, overall, that are reporting employment growth, very moderate, are education, government and healthcare.

What’s missing? Are we going to see massive downward revisions?

Permalink | Comments

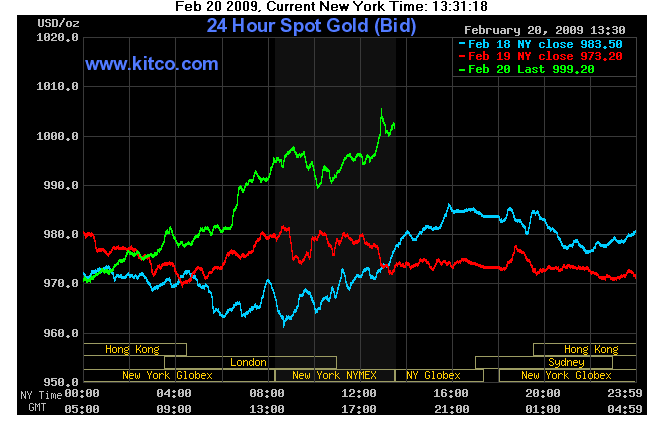

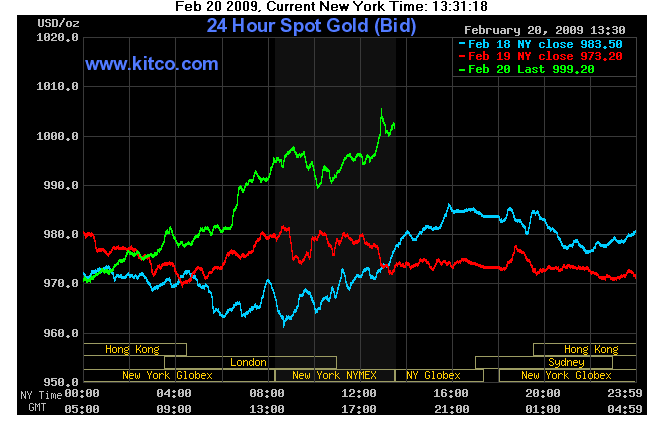

Without any great fanfare, gold is poised to break above $1000/ounce, right now at $986 after a steady drift upward this week. Maybe we’ll come in tomorrow AM and see new highs.

According to Bloomberg, The SPDR Gold Trust, a gold backed security, is now the seventh-largest holder of gold, after the International Monetary Fund and the governments of the U.S., Germany, France, Italy and Switzerland. As of yesterday that security had 1,008.8 metric tons. The unabating hunger for gold among currency-fearing investors is going to push SPDR holdings steadily up in the league tables of gold holdings, so that SDPRs now account of more gold than the reserves of the Central Banks of Japan and the UK put together.

$1000 is a big psychological hurdle and surpassing it will undoubtedly spark some headlines — maybe the cover of Business Week with a headline “How High Gold?” — but the historic high in dollars is $1030, reached last July. (Gold’s explosion won’t be over until Business Week’s headline is “Gold Back to the Future: next stop $3000?”)

More important than the $1000 hurdle, it’s important to know that gold is at unprecedented levels versus the Euro and Sterling, two currencies that being sucked into a whirlpool of capital flight.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

What’s interesting about watching gold trade is that, historically, gold’s fan base is mostly freaks and black helicopter paranoids. “Gold bugs” are usually déclassé, moonshine and trailer parks to Wall Street’s Dom Perignon and Park Avenue. Once every hundred years, the crazy folks are right.

Permalink | Comments

Martin Peers, in the the Wall Street Journal, picks up the thread on the glut of potential ad space with this great lede:

What does the Internet display-ad market have in common with Zimbabwe?

Both are printing nearly-limitless amounts of their main currency, vastly diminishing its value and undermining their future. The currency, for Web sites, is their ad inventory. And while Zimbabwe, under different management, can change course, the same isn’t true of the display-ad market. Web sites keep generating new content and extra pages on which ads can run.

More thoughts on the advertising inventory glut here.

Permalink | Comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)